how much is virginia inheritance tax

Virginia Inheritance and Gift Tax. This is great news for Virginia residents.

The Difference Between Revocable And Irrevocable Trusts In Estate Planning The Estate Elder Law Center Of Southside Virginia Pllc

How much is virginia inheritance tax.

. How much can you inherit without paying taxes in 2020. Currently each individual may exempt from the gift tax up to 14000000 of gifts. The estate tax rate is 40.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million. How much can you inherit without paying taxes in virginia. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Your average tax rate is 1198 and your marginal tax rate is 22. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. The tax shall be an amount computed by multiplying the federal credit by a fraction the numerator of which is the value of that part of the gross estate over which Virginia has jurisdiction for.

Again this effectively means there is no federal gift tax imposed on the majority of Americans. You might inherit 100000 but you would pay an inheritance tax on only. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

Pennsylvania does charge an inheritance and estate tax in some cases. Estate tax is the amount thats taken out of someones estate upon their death. No estate tax or inheritance tax Arizona.

If you make 70000 a year living in the region of Virginia USA you will be taxed 12100. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. This marginal tax rate means.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. No estate tax or inheritance tax Alaska. No estate tax or inheritance tax Arkansas.

One both or neither could be a factor when someone dies. The worlds highest rate 55 percent is in Japan followed by South Korea 50 percent and France. Virginia estate tax.

Code 581-901 and 581-902 as in effect on December 31 2006. States may also have their own estate tax. A few states have disclosed exemption limits for.

There is no federal inheritance tax but there is a. No estate tax or inheritance tax California. The top estate tax rate.

The exemption is 117. Today Virginia no longer has an estate tax or inheritance tax. The top estate tax rate is 16 percent exemption threshold.

Has the fourth highest estate or inheritance tax rate in the OECD at 40 percent. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

New Jersey Estate Tax Changes Mccarthy Weidler Pc

Virginia Tax Calculator Estimate Your Taxes Forbes Advisor

Virginia Inheritance Laws What You Should Know Smartasset

State Local Tax Assignment Goopenva

Estate Tax Calculator Washington Dc Maryland Virginia Lawyer Attorney Law Firm

Maryland Raises Estate Tax Exemption Wealth Management

What You Need To Know About The 2022 One Time Tax Rebate Virginia Tax

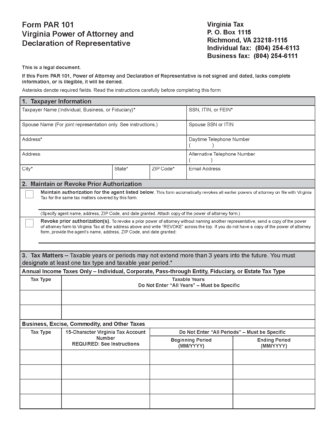

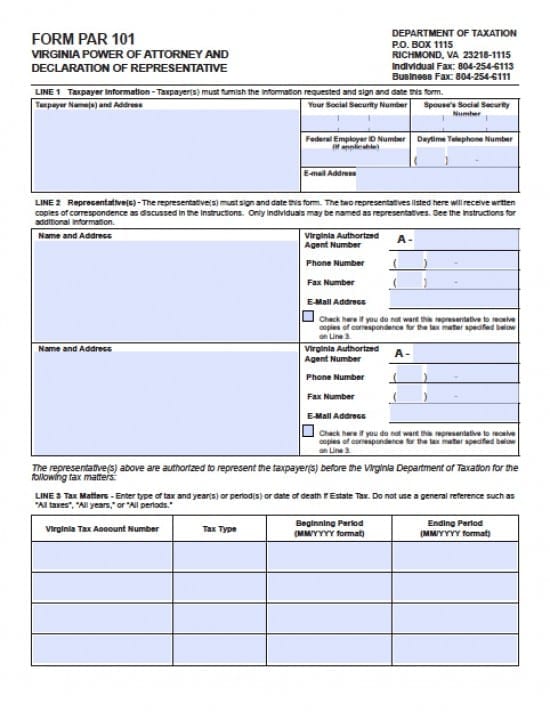

Virginia Tax Power Of Attorney Form Power Of Attorney Power Of Attorney

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Does Your State Have An Estate Or Inheritance Tax

Estate Tax Planning In Virginia The Nance Law Firm

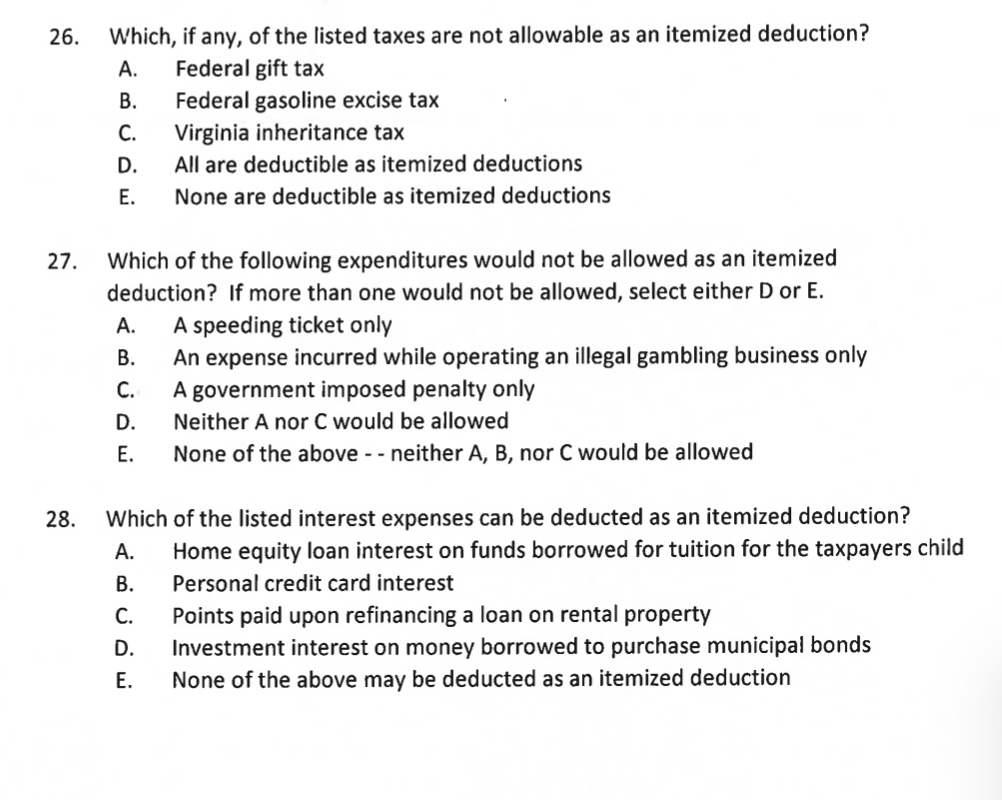

Solved 26 Which If Any Of The Listed Taxes Are Not Chegg Com

Virginia Ggu Tax Estate Planning Review

Estate And Inheritance Taxes By State In 2021 The Motley Fool

Estate Taxes Virginia Wills Trusts Estates

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Pdf The Federal Estate Tax History Law And Economics Semantic Scholar

Ranking Property Taxes By State Property Tax Ranking Tax Foundation